Strategy SCHD/TQQQ

How exactly does this strategy work? And what can you expect when you start using it? I’d be happy to explain the principles behind it and give you an idea of the results you can anticipate based on past performance.

SCHD and TQQQ: The Foundation and Growth Engine of the Portfolio

SCHD forms the solid foundation of the portfolio, built on high-quality companies. This ETF is characterized by low volatility, steady growth, and regular dividends. It stands out as one of the best in its category, making it the cornerstone of our strategy. TQQQ, on the other hand, brings dynamism and significant growth potential. It is a highly volatile ETF that reacts threefold to every movement of the NASDAQ index, making it an ideal tool for accelerating portfolio growth.

By combining the stability of SCHD with the growth potential of TQQQ, we enhance the overall performance of the portfolio. During bullish periods, we allocate more to SCHD, while during market downturns, we strategically increase positions in TQQQ based on fundamental or technical analysis. This approach allows us to capitalize on price drops to maximize growth.

Additionally, I focus on intraday trading, particularly with TQQQ, which often experiences daily movements of several percent. Leveraging my experience in forex trading and working with NASDAQ, I identify opportunities for quick profits. As a result, you can expect several short-term trades per day, further contributing to the portfolio’s growth.

SCHD (Schwab U.S. Dividend Equity ETF)

SCHD (Schwab U.S. Dividend Equity ETF) is one of the popular exchange-traded funds (ETFs) focused on dividend-paying stocks in the U.S. This ETF is managed by Charles Schwab and is known for its emphasis on high-quality stocks that provide stability, growth, and dividends.

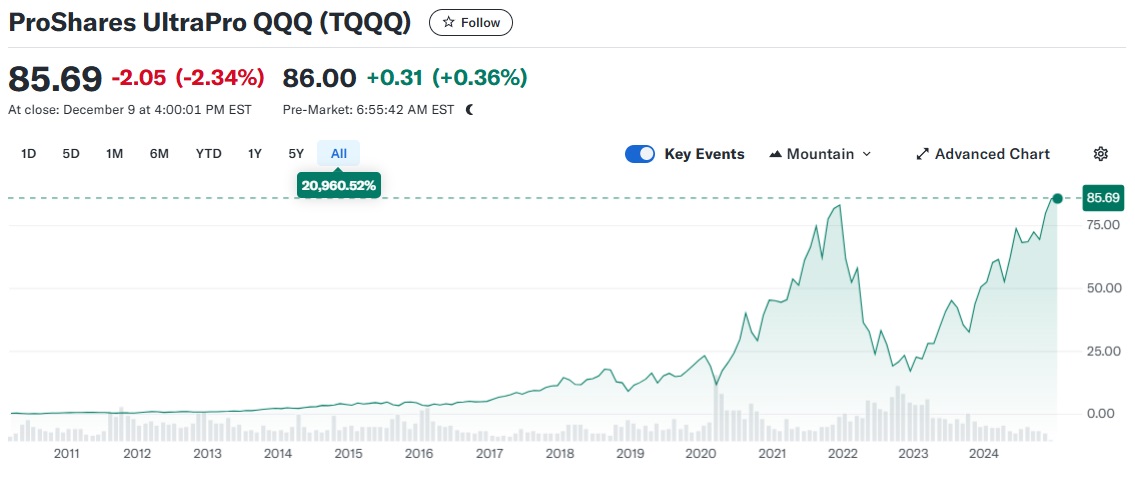

ProShares UltraPro QQQ ©

TQQQ (ProShares UltraPro QQQ) is a triple-leveraged ETF (leveraged exchange-traded fund) designed to deliver three times (3x) the daily returns of the NASDAQ-100 index. This ETF is primarily suited for experienced traders and investors seeking short-term speculation on the movement of technology stocks.

Intraday & Swing

A strategy combining intraday and swing trading merges two different approaches to maximize profits and efficiently manage a portfolio. The goal is to capitalize on short-term price movements during the day (intraday) while also benefiting from larger trends over a few days or weeks (swing). This strategy is flexible but requires thorough risk management and a solid understanding of the markets.